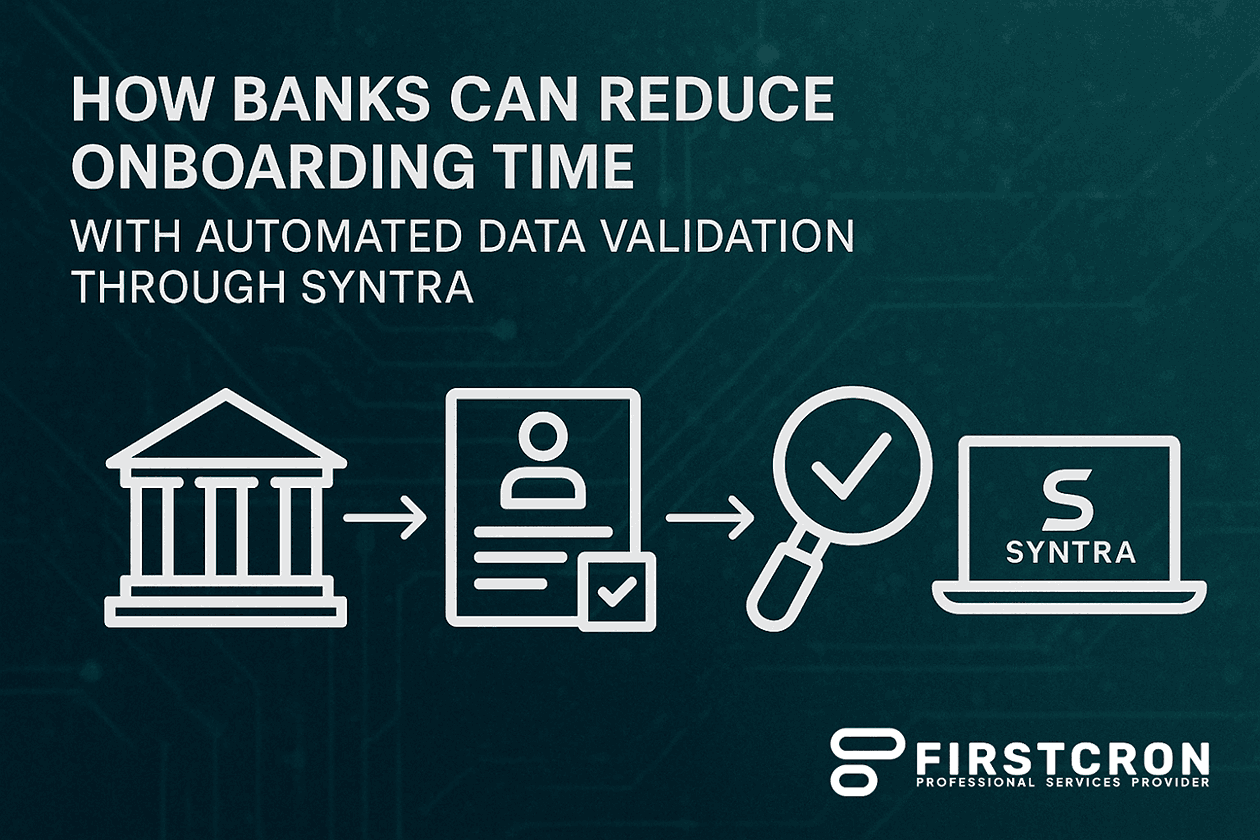

In today’s digital-first banking environment, customer expectations for fast, seamless onboarding have never been higher. Yet many banks still struggle with onboarding timelines that stretch into days or even weeks due to manual checks, fragmented data sources, and repeated validation cycles. Slow onboarding not only frustrates customers but also leads to drop-offs, lost revenue opportunities, and increased operational costs. Automated data validation through Syntra offers banks a powerful way to streamline onboarding processes while maintaining regulatory compliance and data integrity from day one.

In this blog we’ll cover

- Data Complexity In Modern Bank Onboarding

- Regulatory Pressure And Compliance Requirements

- What Automated Data Validation Through Syntra Means

- Accelerating Onboarding Through Real-Time Validation

- Reducing Operational Effort And Cost

- Improving Data Quality Across Downstream Systems

- Supporting Scalable And Digital-First Banking Models

- Enhancing Customer Experience And Trust

- Conclusion: Transforming Bank Onboarding With Syntra

Data Complexity In Modern Bank Onboarding

Bank onboarding involves validating a wide range of customer data, including personal details, identification documents, addresses, tax information, risk indicators, and account preferences. This data often arrives from multiple channels such as online forms, branch systems, third-party KYC providers, and legacy platforms. Inconsistent formats, missing fields, duplicate records, and human entry errors create delays as operations teams manually review and correct information. Without automated validation, banks spend significant time reconciling data issues rather than focusing on customer engagement and growth.

Regulatory Pressure And Compliance Requirements

Compliance requirements add another layer of complexity to onboarding. Banks must adhere to strict KYC, AML, and regulatory reporting obligations that vary by jurisdiction. Any error or oversight in customer data can result in failed compliance checks, audit findings, or regulatory penalties. Manual validation processes increase the risk of inconsistency and subjectivity, making it difficult to demonstrate strong controls. Automated data validation through Syntra enforces standardized rules and compliance checks consistently across all onboarding cases, reducing risk while accelerating approval cycles.

What Automated Data Validation Through Syntra Means

Syntra enables banks to automate data validation by applying intelligent rules, pattern recognition, and exception handling at the point of data ingestion. Instead of validating data after submission, Syntra ensures that customer information is checked in real time against predefined business and regulatory rules. This includes format validation, mandatory field checks, cross-field consistency, duplication detection, and reference data verification. By addressing issues early, Syntra eliminates rework and prevents incomplete or incorrect records from progressing further into the onboarding workflow.

Accelerating Onboarding Through Real-Time Validation

One of the most impactful benefits of automated data validation is the ability to process onboarding requests in near real time. Syntra validates customer data as it is captured, allowing banks to approve low-risk customers quickly while routing only genuine exceptions for manual review. This significantly reduces onboarding cycle time and improves first-time-right processing. Faster onboarding translates directly into improved customer satisfaction, higher conversion rates, and quicker activation of banking products and services.

Reducing Operational Effort And Cost

Manual data validation consumes a large portion of onboarding operations effort, requiring skilled staff to review documents, verify fields, and resolve discrepancies. Syntra reduces this dependency by automating repetitive checks and highlighting only high-risk or non-compliant cases. As a result, banks can redeploy operations teams to higher-value activities such as customer support, risk analysis, and relationship management. Reduced manual effort also lowers operational costs and minimizes the likelihood of human error.

Improving Data Quality Across Downstream Systems

Onboarding data flows into multiple downstream systems, including core banking, CRM, risk platforms, and reporting tools. Poor data quality at the onboarding stage propagates issues across these systems, leading to reconciliation challenges and inaccurate reporting. Automated data validation through Syntra ensures that only clean, standardized, and compliant data enters the bank’s ecosystem. This improves data consistency across systems and strengthens overall data governance, making future audits, reporting, and analytics more reliable.

Supporting Scalable And Digital-First Banking Models

As banks expand digitally and onboard customers at higher volumes, scalability becomes critical. Manual validation processes do not scale efficiently and often become bottlenecks during peak demand periods. Syntra supports high-volume onboarding by handling large datasets and concurrent validations without compromising accuracy. This scalability enables banks to launch digital onboarding initiatives, support new products, and enter new markets without increasing operational overhead or risk exposure.

Enhancing Customer Experience And Trust

A smooth onboarding experience sets the tone for the entire customer relationship. Automated data validation reduces back-and-forth communication caused by data errors or missing information. Customers experience faster approvals, fewer resubmissions, and clearer feedback during onboarding. Over time, this builds trust and reinforces the bank’s reputation as a reliable and customer-centric institution. By reducing friction at the first interaction, banks increase long-term engagement and loyalty.

Conclusion: Transforming Bank Onboarding With Syntra

Reducing onboarding time is no longer optional for banks competing in a digital and highly regulated landscape. Automated data validation through Syntra addresses the root causes of onboarding delays by improving data quality, enforcing compliance, and eliminating manual inefficiencies. By embedding intelligent validation into onboarding workflows, banks can accelerate approvals, reduce risk, and enhance customer experience simultaneously. Syntra enables banks to move from reactive data correction to proactive data quality management, transforming onboarding into a strategic advantage rather than an operational challenge.

Tags

Related Post

Navigating Oracle Fusion HCM & Payroll Patch 25C: Key Issues And Solutions For UK Local Councils

July 26th, 2025 10 min read

Learning And Talent Management With Cornerstone OnDemand

October 10th, 2025 17 min read

7 Proven Oracle Fusion Testing Principles To Guarantee Defect-Free Cloud Deployments

May 16th, 2025 15 min read

7 Reasons Why Companies Are Moving From Taleo To Oracle Recruiting Cloud

June 2nd, 2025 14 min read

Navigating Oracle Fusion HCM & Payroll Patch 25A: Key Considerations For UK Local Councils

July 27th, 2025 10 min read

WEEKEND READS

Navigating Oracle Fusion HCM & Payroll Patch 25C: Key Issues And Solutions For UK Local Councils

July 26th, 2025 10 min read

Learning And Talent Management With Cornerstone OnDemand

October 10th, 2025 17 min read

7 Reasons Why Companies Are Moving From Taleo To Oracle Recruiting Cloud

June 2nd, 2025 14 min read

UKG (Ultimate/Kronos) — USA And Global, Legacy-to-Modern Workforce Management

October 5th, 2025 23 min read

Data Migration Best Practices: From Taleo To Oracle Recruiting Cloud

May 28th, 2025 13 min read

Voice-to-Action In Oracle HCM: Transforming HR Queries Into Intelligent Actions With GenAI

September 5th, 2025 23 min read

Understanding Oracle Fusion HCM And Payroll Patch 25B: Key Issues And Solutions For UK Local Councils

July 28th, 2025 10 min read

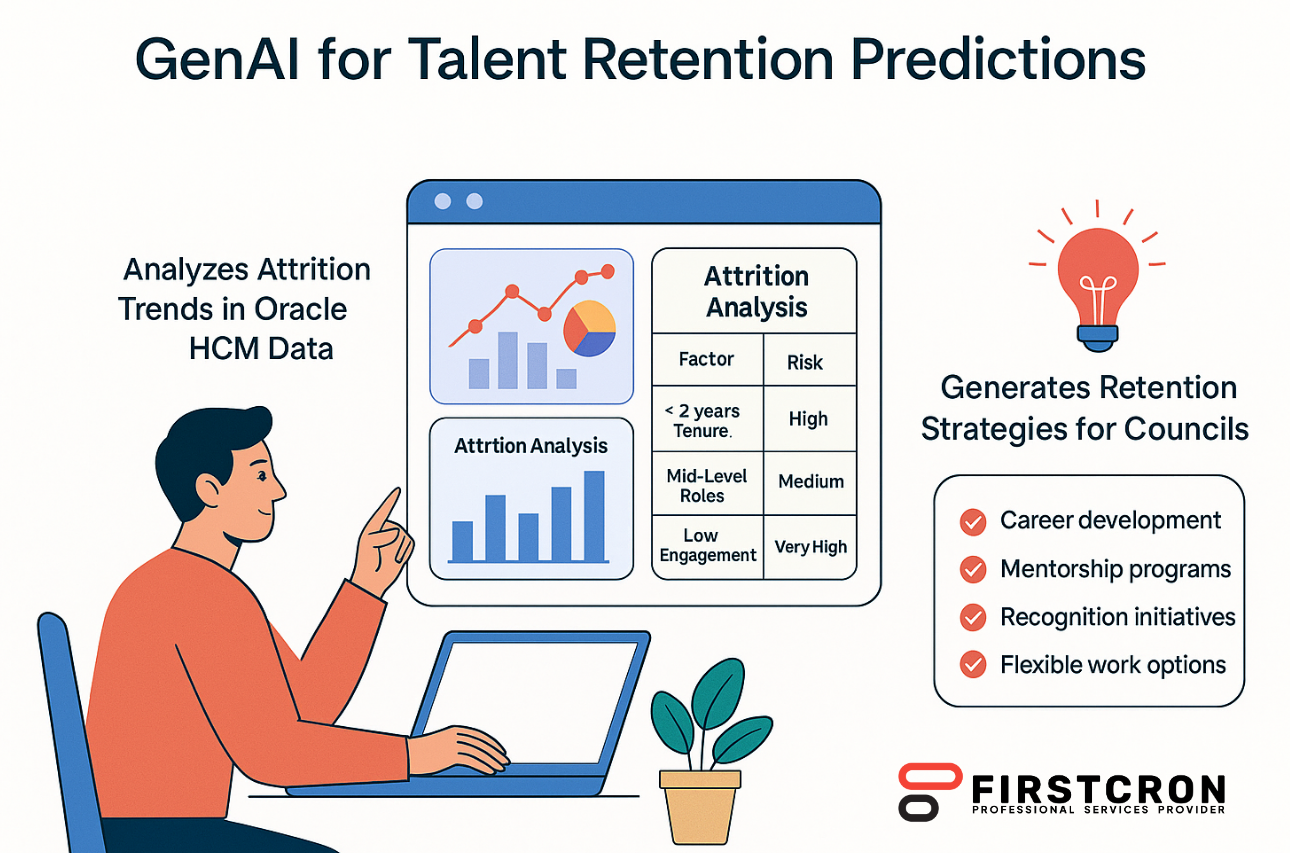

GenAI For Talent Retention Predictions: Unlocking Workforce Stability With Oracle HCM

September 4th, 2025 18 min read

Using IoT Devices For Workplace Safety Monitoring

November 9th, 2025 17 min read

Syntra-Powered ETL In A Ceridian Dayforce Landscape: Transforming ADP To Oracle Fusion For North American Payroll & HCM

October 4th, 2025 20 min read